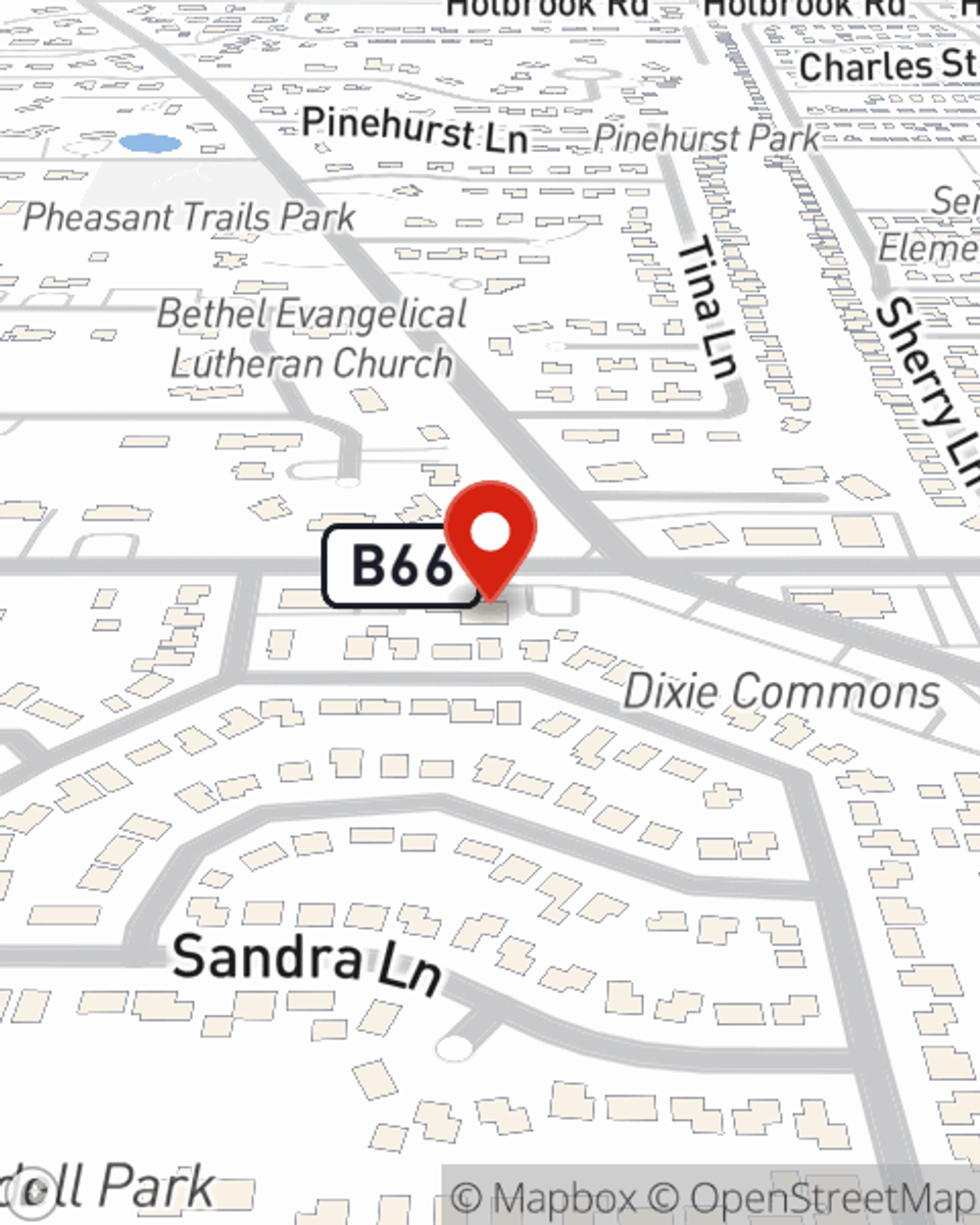

Condo Insurance in and around Chicago Heights

Welcome, condo unitowners of Chicago Heights

State Farm can help you with condo insurance

Your Personal Property Needs Coverage—and So Does Your Condo Unit.

When you think of "home", your condo is first to come to mind. That's your home base, where you have made and are still making memories with your favorite people. It doesn't matter what you're doing - laughing, resting, playing - your condo is your space.

Welcome, condo unitowners of Chicago Heights

State Farm can help you with condo insurance

Condo Unitowners Insurance You Can Count On

We get it. That's why State Farm offers outstanding Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Julie Nash is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that provides what you want.

When your Chicago Heights, IL, residence is insured by State Farm, even if something bad does happen, State Farm can help guard your condo! Call or go online now and see how State Farm agent Julie Nash can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Julie at (708) 798-3550 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.